Deal Targets

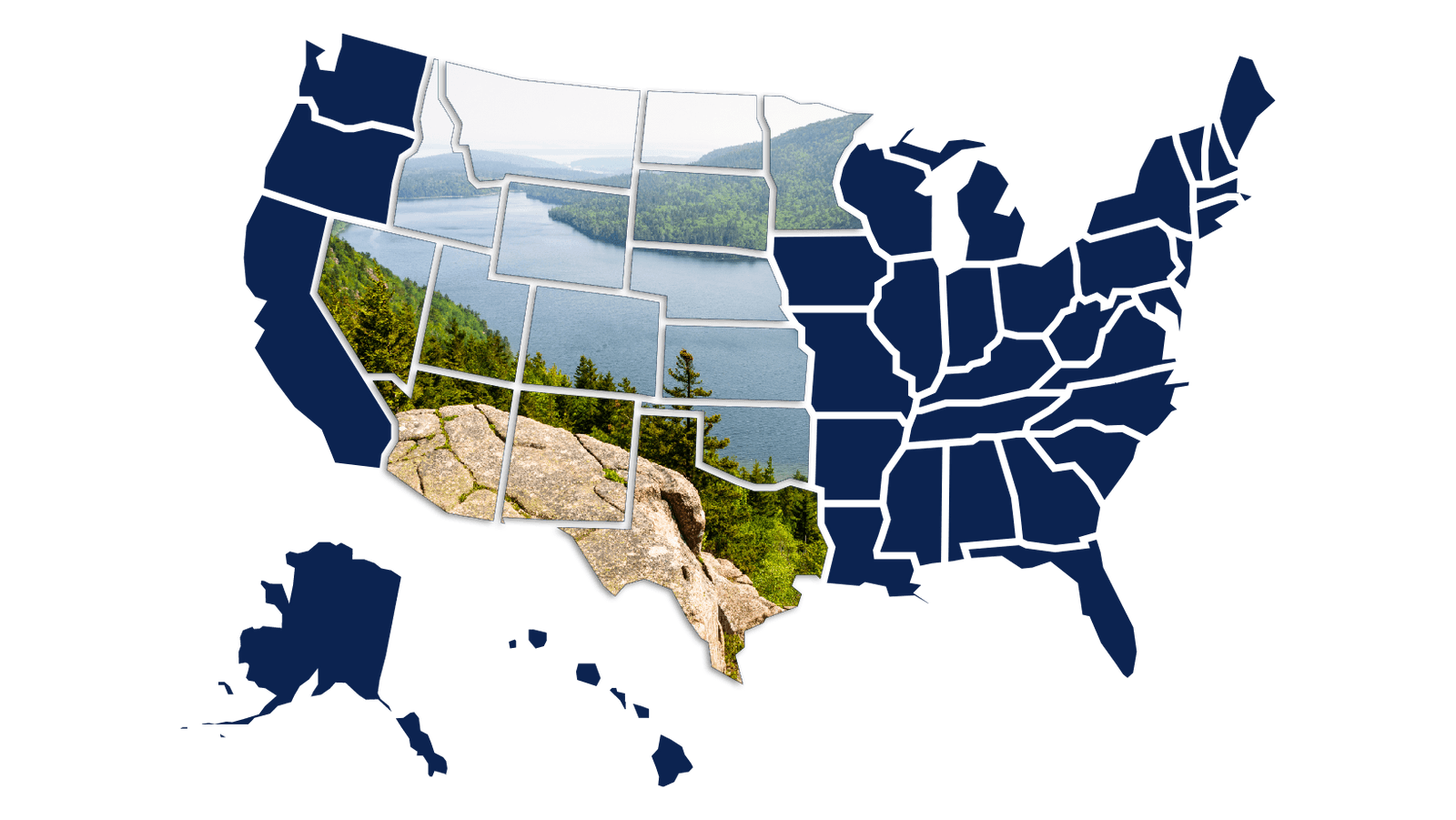

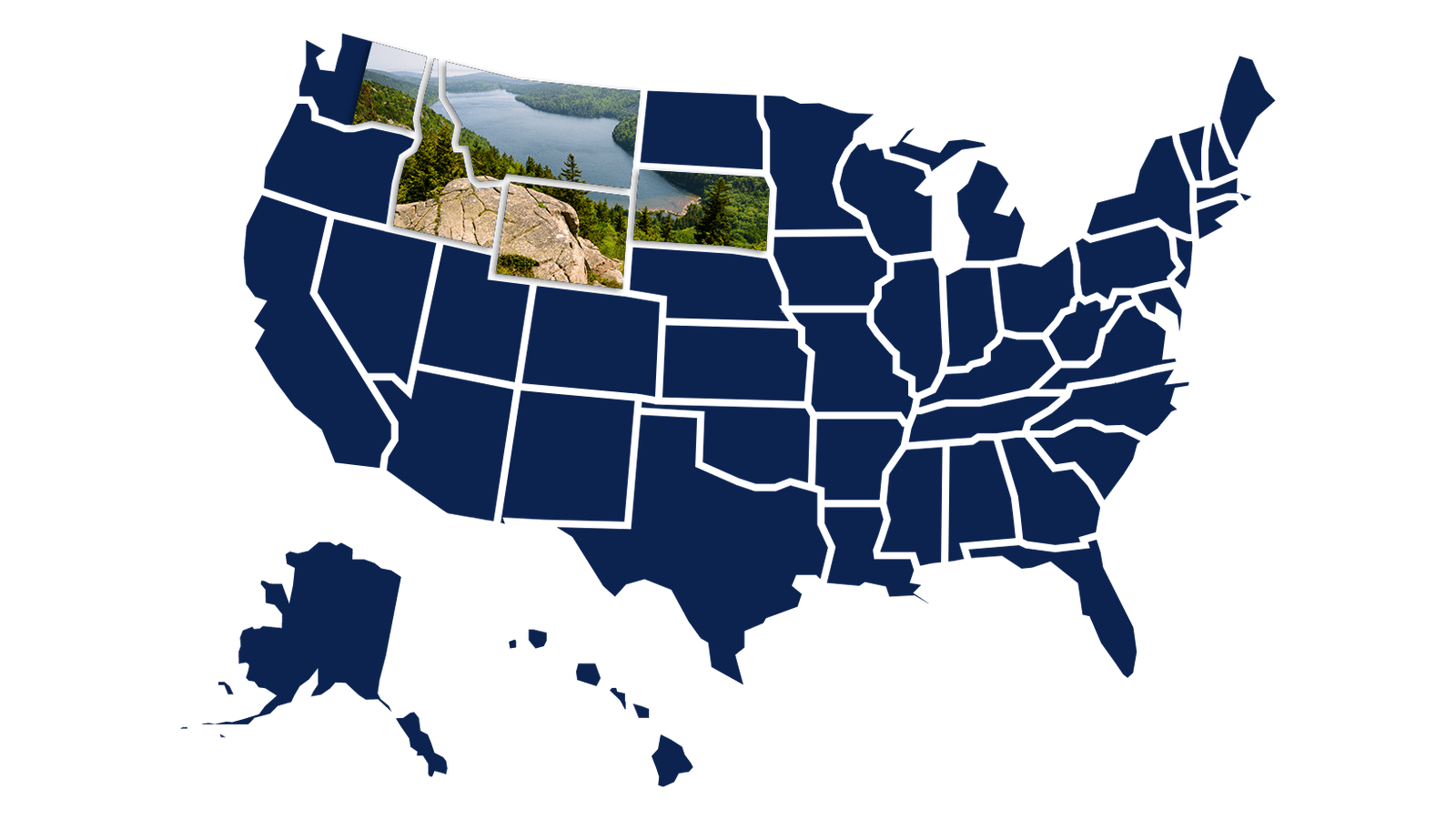

We are aggressively seeking opportunities to acquire industrial real estate across the new Industrial Heartland of the Intermountain West, Upper Midwest, and Southwest.

We focus primarily on warehouse, distribution, and light manufacturing assets.

We have a reputation of making decisions quickly and being a dependable partner to efficiently move a transaction from offer to close. We move on opportunities when we believe we can close on them. We take pride in not wasting our deal partners' time tying up assets we don't have confidence we will close on.

Industrial Heartland

Profile: Single & Multi-Tenant, Vacant or Occupied

Building Type: Class B & C

Building sizes: 70,000+ SF

Occupancy: Vacant, partially vacant or income-producing

Use: Heavy and Light industrial (e.g. Warehouse, Distribution, Manufacturing, Flex)

Construction Type: Concrete, Masonry, Steel Frame Metal, Tilt-Up

Deal size: $5M+

Partner Incentives

1% Bonus

We offer our partners a 1% bonus to seller-paid commissions.

Upper Rockies Emerging Markets

Profile: Single & Multi-Tenant Value-Add

Building Type: Class B & C

Building sizes: 25,000+ SF

Occupancy: Vacant, partially vacant or income-producing

Use: Heavy and Light industrial (e.g. Warehouse, Distribution, Manufacturing, Flex)

Construction Type: Concrete, Masonry, Steel Frame Metal, Tilt-Up

Deal size: $3M+

We view our broker and acquisition partners as long-term partners of our business. We offer strong incentives to our partners to foster a partnership of mutual success.

Co-Investment Opportunities

We offer our partners the opportunity to contribute capital alongside us in the deals they bring us.

Note: Incentives are determined on a deal by deal basis, are not guaranteed, and are only available to individuals who successfully close a deal with Freehouse Capital Partners.

Reach out to our deal team

Patrick Olson, Partner

(406) 545-4158

patrick@freehousecapital.com